What Is a 4 Point Inspection?

A 4 point inspection is a wonderful tool to find out the overall health of your home. It looks at 4 major systems that can weather with age and they include the roof, electrical, plumbing, and your HVAC. You will provide this report to your insurance company and they will make a decision regarding your coverage.

Because older homes are more likely to need extensive repairs, your insurance company will need reassurance about these major parts of your home. They want to make sure they’re in good condition before they issue you a policy. This is true for new policies or existing ones. So don’t be surprised if your home’s age is coming up on 30 years and your insurance company all of the sudden requires one.

A four-point inspection checklist is much shorter than a full inspection checklist, and cannot act in place of a buyer’s inspection if you are buying a home. By the same token, a buyer’s inspection should not be used in place of a four-point inspection. It’s best to provide your insurance company with only the information they asked for. Check with your insurance company first to see if there is any other information they need that a four-point inspection would not cover.

Roof

The inspector will take a look at what type of roof you have, the age, and the condition. S/he will also account for damage, low-lying trees, leaks, or missing components. They also look at the shape of your roof because it has been found that certain shaped roofs can withstand the elements better than others.

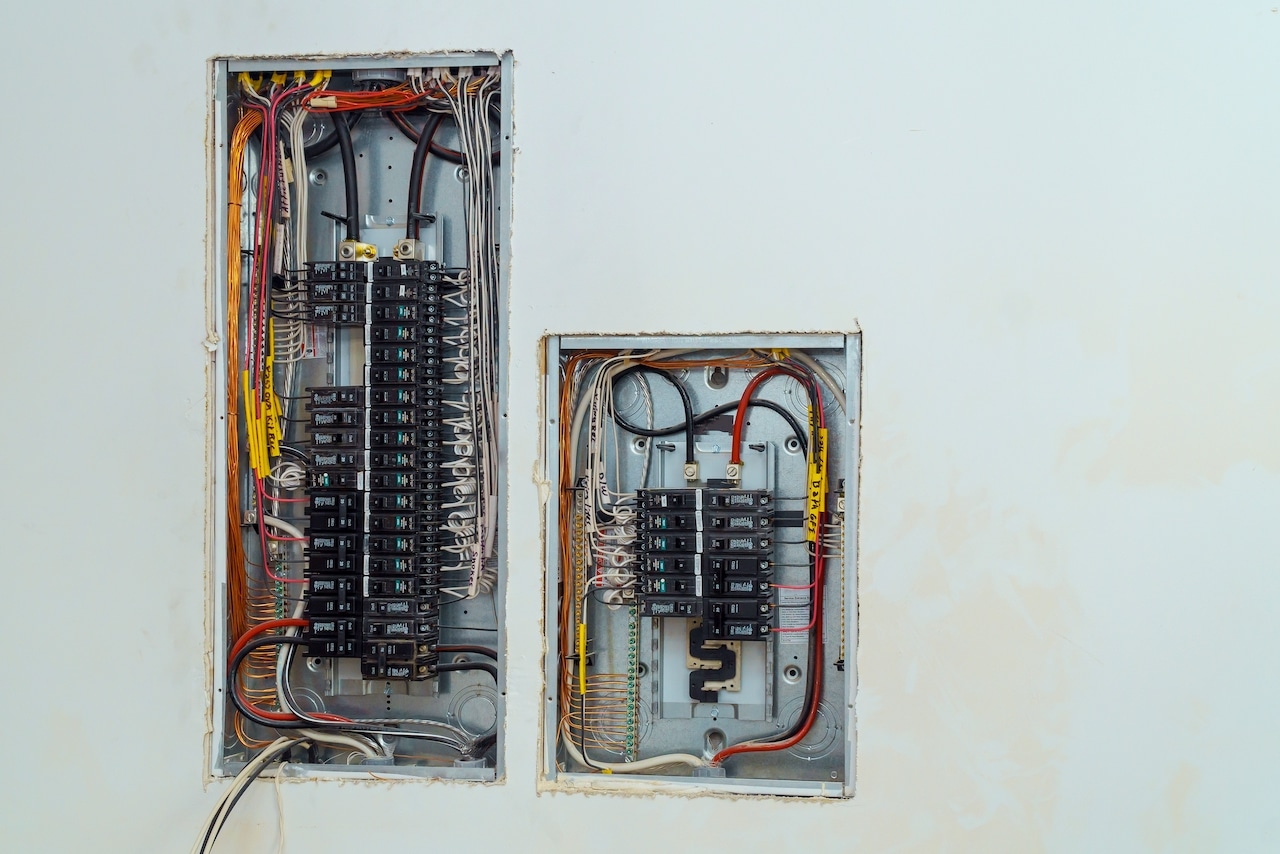

Electrical

Your inspector will look at what type of wiring you have. Some older homes are not up to code when it comes to wiring so they will be making sure your home is safe. They will also look at your electrical panel and what condition it is in.

S/he will also make sure that all of your outlets are grounded and that your electrical system is the right size for your home.

It’s worth a note that even if you have some issues that are not up to code, you can still pass your 4-point inspection. It will all depend on the severity of the code violation.

Plumbing

For plumbing your inspector will take note of what types of pipes you have, the current condition of these pipes, check for evidence of leaks, and check your hot water heater.

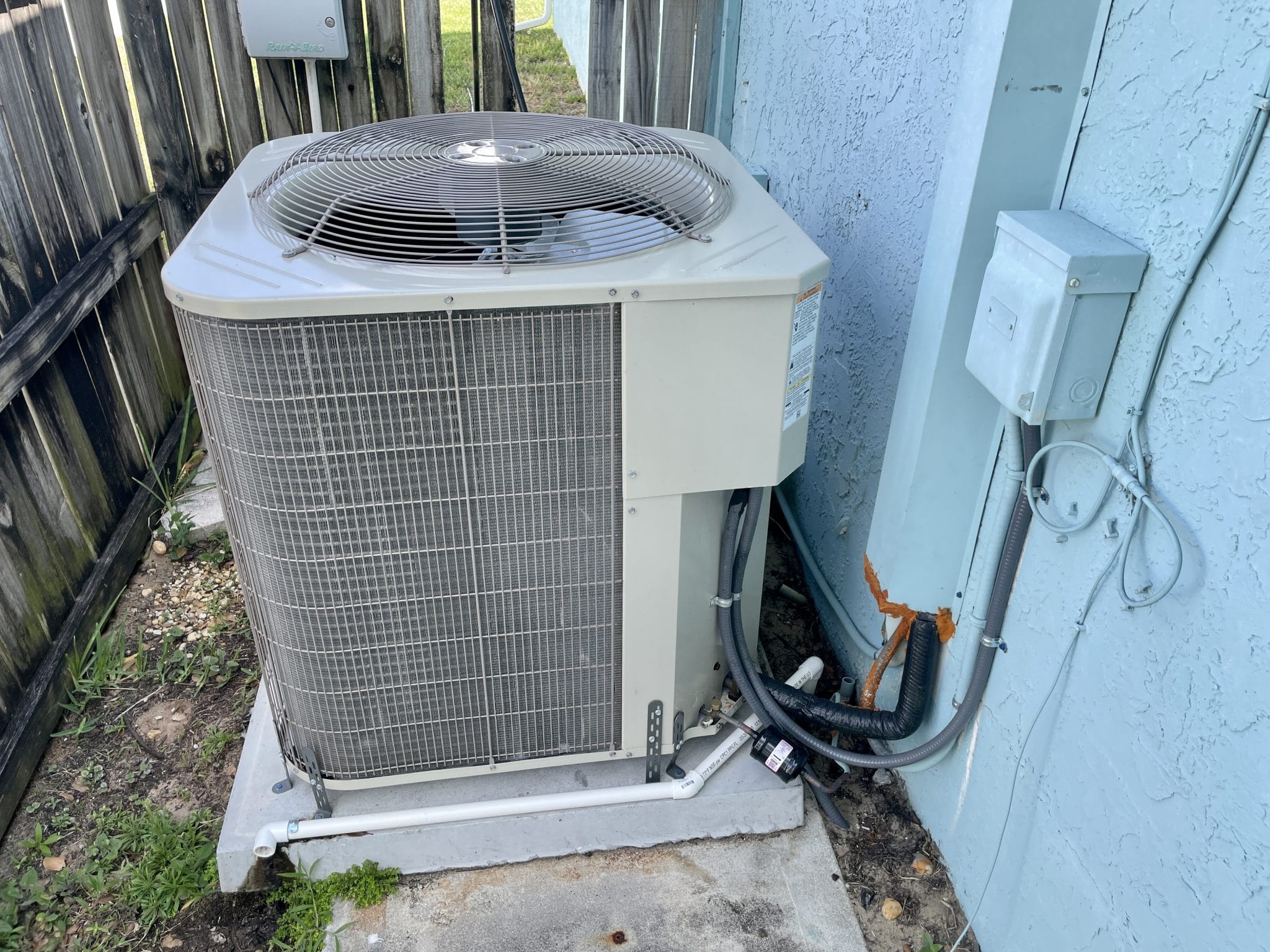

HVAC

Your heating and cooling system is a very integral part of your home. Not only does it heat and cool your living space, but it also ensures climate control in your home. An inspector will take into account the age of your HVAC system, what type of system you have, and the overall condition of the system.

Will I get a discount?

Unlike a wind mitigation inspection, a 4-point inspection will not get you a discount on your homeowner’s insurance policy. A 4-point inspection merely gives the insurance companies the information they need to determine whether they will insure you or not.

Can you fail a 4-point inspection?

Unfortunately, yes you can. If certain aspects of your home are over a certain age, not in proper working condition, or contain materials that are not up to code, you can fail your 4-point inspection.

Can I still get insurance if I fail?

It all depends on what company you’re trying to insure with. In some cases, they will refuse to cover you, in other cases, they will only refuse to cover the problematic areas. For example, if the rest of your home is in wonderful condition but your roof is on its last legs, they can choose not to cover the roof.

The Extra Mile Way

At Extra Mile, we always go the extra mile for our customers. We will make sure that you understand our analysis and we always make ourselves available for questions. Our reports have a quick turn-around and are easy to read, letting you take care of your insurance company’s requirements as quickly as possible.